I started experiencing some tension recently around the idea that there are apparent contradictions within my concept of the path price will be taking in the coming weeks, so I am going to flesh out my current beliefs, in order to clarify things.

As you can see from my Forecast update on 1/11/2021, my anticipation was for prices to reverse around the $28 area, and that the subsequent decline would be quite significant, ultimately taking price back to the sub-$20 area. That belief has not been dramatically altered, as I still have high conviction that price will resolve to those levels before it makes significantly more progress to the upside, i.e. I still believe price has no chance of sustaining itself at/above the $30 level before a more dramatic decline to the downside is accomplished. However, the difference is that now I see the current decline as perhaps a penultimate one which will most likely be a precursor to the definitive decline I have been positioning for.

On 1/7 I bought contracts in SLV put options dated for July 16th of this year. I bought the 24, 20, and 16 strikes. Notice how much time is left on those options (in contrast to other trades I have made in the past six months). The reason for that is because my anticipation for this coming dramatic decline is for it to take perhaps a few months to play out, and I don’t want to be in the uncomfortable position of either 1) time running down and price only achieving part of the expected trip– because that would put pressure on me to book profit prematurely, in the attempt to ward off the potential for price to make a mid-trip reversal which would crush the trade’s profitability, or 2) Attempting to get too ‘cute’ and try to catch each minor move with independent trades within the major move, which very possibly could lead to a situation where I am holding no contracts at all when a significant move happens. So I resolved this potential conflict by buying long-dated options, with the idea that it will be better to ride it the whole way without the worry of each day’s gyrations. I chose the strike prices by reflecting on the “Pole Fitting” dream. The wraps around the lower sections represent the deep out-of-the-money strikes, and the U-shaped pole for the hands represents strikes on either side of the range set from 9/22 – 12/16. The discussion about balance and thickness relates to my allocation/distribution of funds into each of these three options.

So, price declined immediately after my purchases. I bought on Thursday 1/07 near the day’s close, then Friday 1/08 ushered in a roughly 10% drop. What a great way to ‘kick off’ the move, right? Well, I then started getting dreams with information contrary to my assumption that price would continue to decline immediately.

In the “Playful Irony Leads to a Fight…” dream, my comment to the girl out on the upper balcony was about not wanting to necessarily see the other person in a relationship every possible moment. I believe that was referring to my decision to buy long-dated options, as then I wouldn’t need to focus so much on each day’s action, instead keep focus on the big picture, where price would ultimately end up. No need to obsess about the near term. The combination of the physical location (upper balcony) and that attitude of playing the long-game makes me confident in ‘mapping’ that dream’s starting location to the sideways trading around $27.50 from 1/03 – 1/07. From there I went inside, had an argument, then went downstairs where the energetic monkey and raccoons got into a brawl, and I then shut the monkey outside. That would appear to be like how price declined dramatically on Friday 1/08, which was followed by some heightened volatility. Notice the type of animals here as well? Raccoons are archetypally thought of as rascally thieves, and monkeys are nimble alarmists. So them having a fight is likely symbolizing the conflicting beliefs among market participants who disagree about price’s immediate future direction– some see the decline as a ‘heist’ and will look for price to return to highs, and others will be convinced that the ‘sky is falling’, more downside is coming, etc. The Raccoons held their own in that fight, btw.

Next I was swimming along a coastal area in something like a cove or channel, with a choppy swimming stroke, in the shade of a giant mound, thinking of going out to more open water. That would seem to indicate sideways trading and consideration of the potential for price to go significantly beyond the obvious barrier of the $22-23 range. Being in the shadow of the tall mound is symbolic of how the steep decline in price on 1/08 would tend to influence anyone’s concept of what was occurring– anytime price makes a dramatic move one wonders if there’s more to come. In that scene I simply shifted outside of the shadow, signifying a shift in my belief that price would continue to decline immediately. Then I was back inside the kitchen area and basically felt like my girlfriend’s level of conviction in our relationship was not enough to warrant an investment in making a trip together (Hawaii, a green island in the southwest), so I tried to get my plane tickets refunded, but I experienced difficulty in using the automated system– that seemed to give me extra motivation to shoot-first-question-later in closing my position with a profit.

There were other dream elements that came to mind which also cast doubt on my initial strategy. In the “Rooftop Art, Traps and Dilemmas…” dream there was the element of an unfinished painting of Asian woman which depicted her with only one eye. I believe that symbolizes seeing things from only a single perspective. And, in the recent dream of “Catching Up Down South…” there was observing Mr. De Lorenzo with a vacant, distant stare. I believe that is indicative of something like only focusing on the ultimate, long-term view of a situation, but to the neglect of everything immediately in front of him. It aligns with the idea that price can still require some time for ‘build-up’, intermediate gyrations that are worth participating in, prior to the great crescendo, which could amount to quite a lot of fun. It’s not optimum to ignore some of the more feminine aspects of the market, which jives with Mrs. De Lorenzo snuggling up to me, starved for attention & affection.

The recent “Bonus Coins Buys a Gatorade…” dream also makes me think this recent move down in price, which I captured a good portion of, is perhaps one of these preliminary down-drafts, like an air-pocket, and not the final, decisive one. In that dream, after I tallied up my winnings, I bought my mom a red Gatorade. At this time price is at the $25 area, very near the thick red line on my chart, and we all know Gatorade is for refreshment. Then we went uphill on a hike to an amusement park– and recall the amusement park element in the “Rooftop Art…” dream? Once at the location, there was the video of a guy who reminded me of a Night’s Watchman from Game of Thrones– a military post on top of a huge wall which divided the worlds. The $30 certainly looks like a wall at this point. The homosexuality would seem to point toward a master-slave dynamic, where a smaller, lesser-statured, more aged guy ‘serves’ the larger, younger, more brutish of the two. To me this aligns with the idea of price reaching up to the $30 level by means of a smaller, weaker, somewhat feeble uptrend, into the ‘sweet spot’ of a younger, more virile, stronger downtrend. The element of the guy’s penis being like a dog’s head is symbolic of traders acting like dogs in their propensity to chase price, assuming it will continue on the immediate trajectory, just as it is about to reverse.

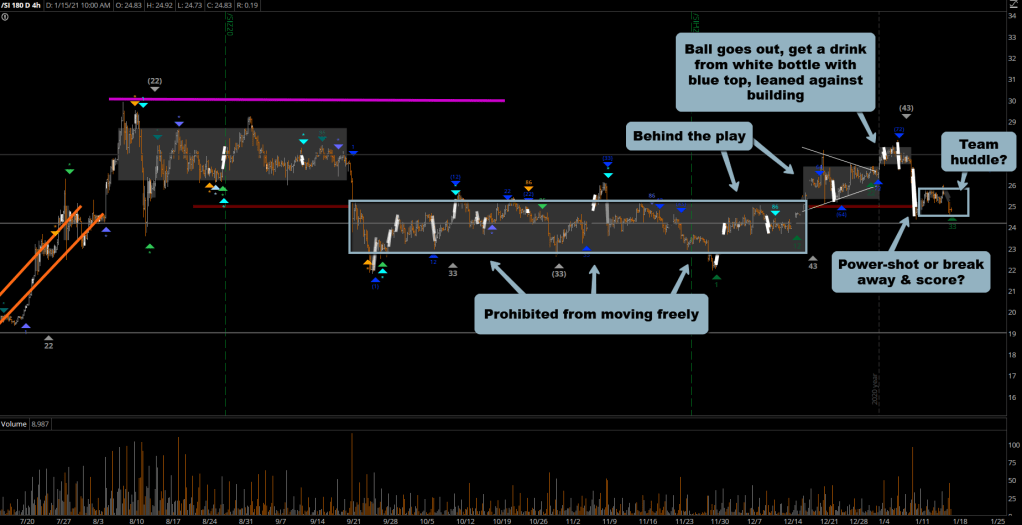

Then there is the “Catching Up, Tiki Taka to Breakaway…” dream. It definitely causes me to doubt the idea of price declining all the way to the original intended target on this current move. I definitely felt ‘behind the play’ when I was not positioned for the anticipated bounce/reversal on 11/30. I believe the initial conditions of being on the right side of the pitch and prohibited from moving freely aligns with price being in a relatively narrow band from 9/21 – 12/14. The ball then went from back to front, and I grabbed a drink from a blue bottle leaning up against the side of a building. That would appear to be the move up to the highs made on 1/06, which I marked on the chart with a blue text note. From there I was suddenly in the upper part of the facility, and more directly involved in the play. I initiated a trade the next day, 1/07– so that all seems in tight alignment.

From there it was a blast through a doorway, followed by the breakaway, a score, then a huddle. So the question is, with price having declined rather swiftly to $26, then to $25, does that constitute the powershot only, or does it include the break-away and score as well? What I come back to is that there was a huddle and then a return trip back up into that Tiki-Taka area, and a celebration in a room adjacent to it. So, regardless of whether there is more action below $25, I fully expect a return trip to $27 or greater. Now that price has gone sideways for five days it would be more likely to satisfy the ‘huddle’ condition.

All of these elements together gives me great conviction that the drop on 1/08 will be recovered in full before the more definitive decline into the sub-$20 region. It would appear to have been a premature attempt at long-term positioning on my part, but which is also somewhat of a perfectly timed, albeit fortuitous-mistake. So, I decided it best to not ‘look the gift-horse in the mouth’, and book profits while they were on the table.